…and why won’t ministers allow such alternatives to be considered by local government?

The wider Political context is Labour’s Dr Nik Johnson’s election victory back in May 2021 where to the surprise of many of us, he won the Combined Authority Mayoral Election running on a promise to prioritise improving buses – see this interview from August 2021. Therefore, bringing in, and adding to the precept should not come as a big surprise. And now for the news.

You may have seen the headline: “Plans to treble tax precept for buses ‘fair'”

“[Combined Authority Mayor] Nik Johnson proposes raising the mayoral precept from £12 to £36 for Band D households in the next financial year, to raise £11m.”

Joanna Taylor LDR for BBC News

“What does ‘Band D” actually mean?”

It all comes back to the system of local taxation brought in after the fall of Margaret Thatcher’s Government on the back of the Poll Tax protests. The LGIU explained how the new system worked against the old rating system back in 1993 – have a look here.

Basically it means that Combined Authority Mayors can add additional amounts to council tax bills *to pay for specific services that fall within the remit of the Mayors*

For Cambridgeshire, the council tax bands are set out in the table below, and are explained here by Cambridgeshire County Council

| Band | Ratio | Amount |

| A | 6/9 | £1,028.58 |

| B | 7/9 | £1,200.01 |

| C | 8/9 | £1,371.44 |

| D | 9/9 | £1,542.87 |

| E | 11/9 | £1,885.73 |

| F | 13/9 | £2,228.59 |

| G | 15/9 | £2,571.45 |

| H | 18/9 | £3,085.74 |

Above – Council Tax bands for Cambridgeshire County Council 2023/24

The additional £24 to council tax bills for a Band D property is about 1.6% of the current £1,542 of the County Council element of the tax bill

***Additionally***, the following also apply

- District/City Councils:

- Cambridge City: £218.85

- East Cambridgeshire: £142.14

- Fenland: £255.24

- Huntingdonshire: £155.86

- South Cambridgeshire: £165.31

- Police & Crime Commissioner: £272.52

- Fire & Rescue Service: £79.92

- Combined Authority: £12.00 – which the Mayor proposes raising to £36

- Parish Councils – these charges vary

So in the grand scheme of things, the mayoral precept for buses is a very small element *compared with the rest of the precepting/charging authorities*. But if you are on a very low income, any rise matters.

“Who gave the Mayor the powers to add to my council tax bill?!?”

Ministers – using powers granted by previous Acts of Parliament approved by MPs.

In particular Section 40 of the Local Government Finance Act 1992 (That’s John Major’s Government – he was also the MP for Huntingdon at the same time, so residents of Huntingdon if you were old enough and voted Conservative, you voted for this. Indirectly anyway!).

The specific part of S40 that matters is paragraph 11, which was added to the legislation by the Cities and Local Government Devolution Act 2016. Again, if you voted for a Conservative MP at the 2015 general election and a Conservative candidate was elected, it is highly likely that your MP voted for this.

Above – Section 40 (11) of the Local Government Finance Act 1992 as amended.

Ministers then brought in the The Cambridgeshire and Peterborough Combined Authority Order 2017 on 02 March 2017

This created the Combined Authority for Cambridgeshire and Peterborough, and the Office of the CPCA Mayor. You can read the Order here.

“Why can’t the Mayor simply tax the rich firms of Cambridge and be done with it?”

Ministers won’t give local government the legal powers to do this. As far as The Treasury is concerned, they are the ones who should be responsible for the vast majority of taxation – and no one else. Some of the more centralising types in Whitehall may see even the limited ability of local government to levy taxes as a constitutional outrage that needs rectifying immediately.

I vaguely recall Margaret Thatcher (or one of her ministers) raging against the prospect of a socialist chancellor of the exchequer in every town hall across the land as a reason to limit the ability of councils to impose higher local taxes – ‘the rates’ – which resulted in the concept of ‘rate-capping’ and the short-lived rebellion from some left-wing-led councils in the mid-1890s, in particular Liverpool. Hence Liverpool has been both a political and historical case study used by supporters and opponents of the Labour Left on what happens when a left-wing Labour group wins control of a city council.

It is that memory that sticks long in the institutional memory – various parts of Whitehall taking the view that local councils collectively are not responsible enough to be given such large revenue-raising powers independent of The Treasury. But then their opponents respond that unless you give them the powers in the first place, they’ll never learn how to become responsible. The challenge is finding the balance between protecting civic assets vs enabling the electorate and local government to evolve and grow so that towns and cities can take control of their own destinies.

Above – the conclusion of the Layfield Committee in 1976, and the case for educating citizens published in Edinburgh in 1947

“So, what are the options on funding local councils?”

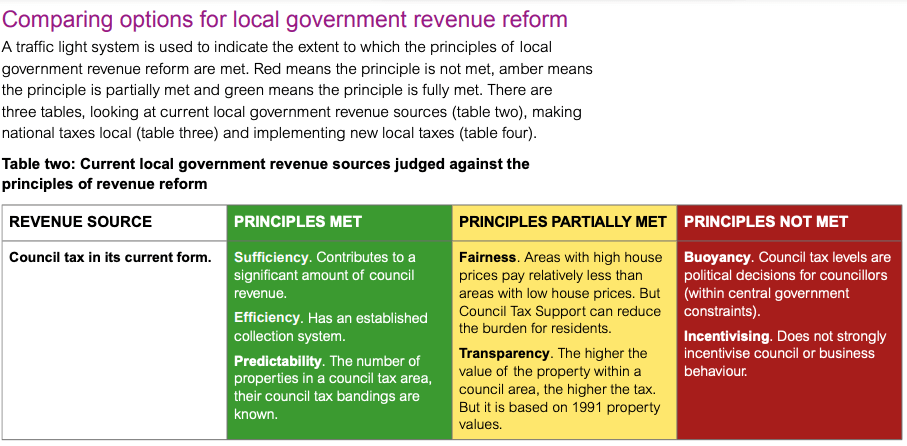

The Local Government Association had a look fairly recently.

Above – Reforming Revenues, by the LGA 2022

As the report says in its intro:

“…four significant issues with local government revenue

financing remain unresolved:

- Adequately funding councils to deliver services of an acceptable standard.

- Making the UK taxation system fairer for those who pay taxes.

- Giving councils more tools to encourage local growth.

- Enabling councils to deliver policies that have a wider societal benefit (such as

reaching Net Zero).”

In the Cambridgeshire context, £24 to someone on a low income is not the same as to someone on a very high income. The precept is still the same (as I understand it). Therefore the current system of local taxation as designed by John Major’s Government that none of the following governments have changed, is **regressive** – it has a greater impact on those on lower incomes who have to pay disproportionately more of their income.

Hence the unfairness bit.

The paper then goes onto explore the alternatives vs the current system from p12.

Above – from LGA 2022, p12 ono

Note they consider road user charging and workplace parking levies.

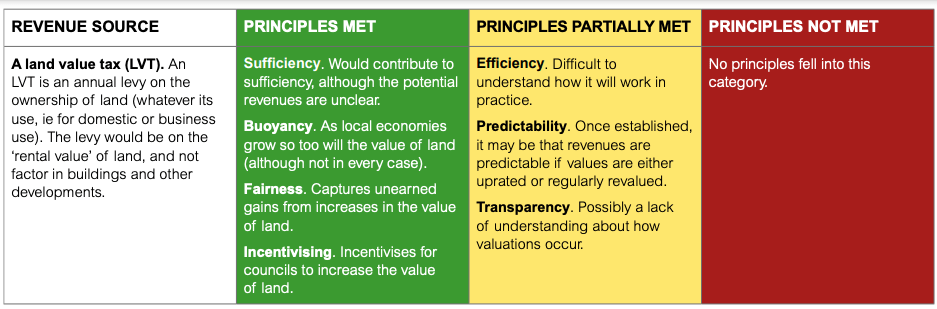

I particularly like the Land Value Tax – explored below.

Above – LGA (2022) p22

All of these however, would require new legislation. Yet there is an opportunity every year to do this – the annual Budget statement (i.e. the Second Reading of the Finance Bill) – although more realistically it would need its own new Local Government Finance Bill tabled to enable MPs and Peers to thrash out the detail. That’s something that the public and candidates may want to consider in the run up to the general election.

Food for thought?

If you are interested in the longer term future of Cambridge, and on what happens at the local democracy meetings where decisions are made, feel free to:

- Follow me on Twitter

- Like my Facebook page

- Get involved with town-based organisations such as those featured on Cambridge Resilience Web

Above – You and the State – from the late 1940s – it covers what taxes pays for